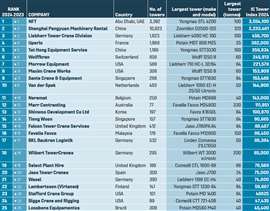

IC Tower Index 2024: slower growth but big cranes lead the way

29 October 2024

Less growth all round than last year’s IC Tower Index – once again. Alex Dahm reports.

While the top line total Index figures for the top 20 and top 5 tower crane-owning companies in the world were still up, it was by less than half of last year’s increase which was itself lower than the year before.

Five Morrow cranes by the ocean working on the Aria Reserve Project in Miami, Florida, USA. (Photo: Morrow)

Five Morrow cranes by the ocean working on the Aria Reserve Project in Miami, Florida, USA. (Photo: Morrow)

There was also rather less of an increase in the other metrics too, to the point where the total numbers of cranes, employees and depots all showed a rise of less than 1 per cent.

It is interesting to note the top 20 and top 5 Tower Index totals were up by 2.7 and 3.2 %, respectively. The 2023 top 20 total was 8,597,720 points and this year it is 8,831,496. In both cases this is the lowest increase in at least the last ten years but an increase all the same.

Looking at the long-term trend might give a better feeling too. The IC Tower Index headline top 20 total ten years ago was 2,270,644 points while this year it is 8,831,496 points – an impressive increase of 289 %. For the top five companies it was an even grander 304 % jump.

BKL’s Liebherr 340 EC-B flat top tower at work in Germany. (Photo: BKL)

BKL’s Liebherr 340 EC-B flat top tower at work in Germany. (Photo: BKL)

As the Tower Index is a measure of capability it can be determined that while there were only eight more cranes than last year among the top 20 companies, the total capability added to the Index over last year was 233,776 tonne-metres. This shows that cranes are getting bigger and replacing smaller ones.

Half of the top 20 companies posted a higher IC Tower Index figure than last year and only six were down, although that is twice as many as last year. Last year Van der Spek increased its fleet while Maxim reduced it. Since then that has flipped around with the former shedding nearly 4 % and the latter adding 2.5 %.

No exits from the table this year and there are two new entries. These are Stravers Torenkranen from the Netherlands in 27th place and Leavitt Cranes from the USA in 37th.

Places

The top seven companies’ rankings remained unchanged from last year. In first place, for the third year running, NFT added 134 cranes, 284 employees and increased its Tower Index by 229,100 points. That amount is between the size of the Morrow and Wolffkran fleets, both of which are top 10 companies.

NFT has widened the gap from its nearest rival. Last year it was 49 % bigger and this time it has increased that to 59 %. Other companies showing increases include Maxim and Morrow in the USA, BKL and Wasel in Germany.

The first company to have changed position is Maxim in 8th, moving up one place. Sante from Singapore is next, gaining two places in 9th. Van der Spek drops two, Neremat one and then Marr and Shinwoo hang on to their 12th and 13th places, while Tiong Woon then gains two at 14. Falcon and Favelle Favco then each move down one place this year.

If this rate of change that started from 2022 to 2023 continues it looks as though next year’s table could be flat, perhaps at best with a small boost to the Index from a continuation of the trend for bigger cranes to replace smaller ones.

With so much conflict in the world, widespread uncertainty and an imminent US election at the time of writing, it is difficult to forecast strong growth.

That is unless of course the great promise of mega developments in the Middle East and the Kingdom of Saudi Arabia, in particular, will really begin to take off. Perhaps the widely heard story about needing as many as 20,000 tower cranes there will come true.

IC Tower Index

Companies are ranked by their IC Tower Index, calculated as the total maximum load moment rating, in tonne-metres, of all tower cranes in a fleet. Like last year we have included 25 companies in the IC Tower Index table but the calculations are all still done on the top 20, for consistency with previous years.

All companies in the list, plus other prospective ones, have the opportunity to supply fleet information and other data. Where companies supply the full data the figure used is calculated by them. In cases of insolvency, acquisition or lack of sufficiently up to date information, companies are withdrawn from the table.

While we make great effort to ensure the accuracy of information provided, it cannot be guaranteed and International Cranes and Specialized Transport and its publisher, KHL Group, accept no liability for inaccuracies or omissions.

The IC Tower Crane Index will next be updated in mid-2025. If you’d like your company considered for inclusion please contact Alex Dahm [email protected] for an application form. With more input and the inclusion of more companies we can help build a bigger picture of the global tower crane rental market.

CONECTAR-SE COM A EQUIPE