Outlook for German construction

29 April 2022

German construction is emerging from the Covid pandemic relatively strongly, but is not, as Scott Hazelton of IHS Markit reports, without its challenges

After a modest GDP contraction in the fourth quarter of 2021 linked to re-tightened pandemic restrictions, German economic growth is resuming. However, Russia’s invasion of Ukraine will curtail this rebound due to a renewed worsening of global supply chain problems and an associated inflation boost.

The German construction sector is showing signs of recovery from the pandemic (Photo: AdobeStock)

The German construction sector is showing signs of recovery from the pandemic (Photo: AdobeStock)

The latest leading indicators signal a pronounced service-sector recovery, while manufacturing will be set back by far-reaching sanctions on Russia and the fresh geopolitical uncertainty that the war has triggered.

The inflation forecast now appears even worse than in mid-February; we now expect the broad price level to increase over 5.0% given the war and rising wage-price spiral risks. The acute geopolitical threat posed by Russia is forcing the German government to drastically recalibrate its fiscal and investment agenda.

The most construction PMI needs to be viewed with some caution as it predates active hostilities in Ukraine. February saw an upturn in construction activity across Germany, with the sector recording its strongest performance in two years. With intakes of new work also rising, capacity expansion efforts led to a marked and accelerated increase in employment.

Less positively, latest data showed an uptick in the rate of input cost inflation for the first time in four months, driven in part by a worsening of supply bottlenecks. This was reflected in a drop in business expectations for the coming year.

More construction activity leads to growth

There were notable increases in activity across each of the three broad construction categories – residential, commercial and infrastructure. Growth was led by the commercial segment, which recorded its sharpest rise in activity for over four years.

It was followed closely by infrastructure, the rate of expansion of which picked up to the quickest since July 2017. Housing activity was the laggard in February, its rate of growth having slowed notably.

The construction sector faced an intensification of cost pressures in February. After slowing in each of the previous three months, the rate of input price inflation climbed to its highest since last November. Businesses reported paying more for a range of building materials, including bricks, insulation, timber and a range of metals, alongside higher energy prices.

February’s survey showed an increase in the incidence of supply delays, the first time this has been the case for nine months. Concerns over rising prices weighed on constructors’ confidence in February with more firms expecting a decrease in activity over the next 12 months than those expecting a rise.

Fixed investment suffered less from the pandemic than expected, due to the relative resilience of construction, which constitutes 53% of fixed investment. In 2020, investment in construction grew, while equipment spending fell by 12.3%. This outperformance of construction was corrected only partially in 2021, which was also hindered by building material shortages.

Construction to improve with housing demand

Looking ahead, construction demand will remain supported by pent-up housing demand, migrant needs, historically low interest rates, and additional public spending on transport, energy, IT infrastructure, and the military.

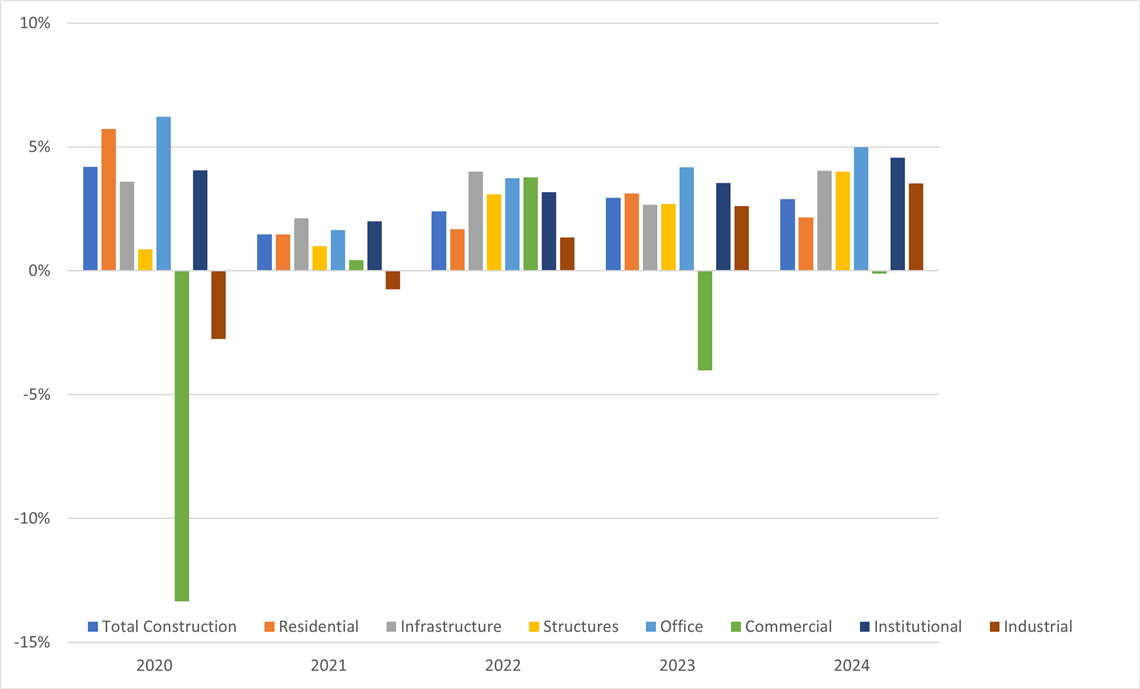

Outlook for Key Construction Types (Percent change, Real 2015 UK €)

Outlook for Key Construction Types (Percent change, Real 2015 UK €)

The outlook for German construction is for continued improvements, but relatively slow growth. Total real construction spending likely slowed to 1.5% in 2021 after a solid 4.5% gain in 2020. IHS Markit expects growth to improve to 2.4% in 2022 with a bit stronger bounce to 2.9% in 2023.

Were it not for the outbreak of war in Ukraine, we would likely have been raising construction forecasts for 2022 and 2023, given favourable financing conditions and rising demand for all three construction sectors – infrastructure due to major investment plans of the new government, regarding the modernisation and structural change to energy, transport, and digital infrastructure; residential due to persisting pent-up demand for housing; non-residential structures due to the cyclical upswing after the loosening of COVID-19 restrictions.

While these supportive influences will not vanish completely, the risk remains for even more drastic sanctions (like an energy import embargo from Russia) to be imposed.

Around 20 January, the German Economic Ministry ended a subsidy program for energy-efficient housing because a landslide of applications far exceeded the pool of funds that had been allocated. The criteria (in terms of levels of energy efficiency needed to qualify) had been far too lenient.

As such, homebuilders suddenly have a gap in their financing plans, even as building costs soar. This further impinges on existing affordability issues, particularly as inflation outpaces wage gains, and diminishes the potential for residential construction.

Office construction offers sustained improvement as the passing of the pandemic allows for return-to-office planning. With some permanent reduction to in-office time, the recovery will be muted. It will take several years to rationalize the current office stock with projected in-office hours. The greatest challenge is to the commercial sector.

There may be some base effect growth in 2022 as the hospitality industry recovers from its deep pandemic slump. However, the retail sector will be a hindrance to growth as e-commerce consumes an ever-larger share of wallet and conventional store growth falls.

While warehousing and logistics will see strong growth, the value of these structures is less than that of retail with a net negative effect. Institutional spending will slightly outpace overall structural spending as health care and educational structures grow with the overall economy but incorporate additional architectural features to allow greater resiliency to disease and improved energy efficiency.

Defence spending

Infrastructure also recovers as the end of Covid-support spending allows for funds to be re-purposed, particularly into energy and transportation projects. Germany’s new government has made infrastructure a priority, although it now remains to be seen whether the need for additional defence spending requires some re-assessment and re-allocation of investment plans.

The German economy is heavily tied to manufacturing. While some new investment has moved to Eastern European countries, such as Poland, domestic investment remains critical. To better see the evolution of priorities, construction spending is grouped in five-year increments above.

Overall, manufacturing will become less important to the construction economy as the rate of growth recedes over the next decade. However, utilities will be a winner as Germany not only works toward a net zero economy itself, but also exports that technology.

As energy independence is achieved, refining becomes less important. Some petroleum-based activity will remain to support the chemical industry, which will also see growth. Transportation equipment investment may tail off as plants complete transition to EVs with fewer parts, but the electrical and electronics industries will pick up some of that slack.

CE Barometer - The calm before the storm in Ukraine - CE January 2022 survey results

The January barometer survey, was undertaken during the first three weeks of February.

CE Barometer is sponsored by Liberty Mutual Surety (Photo: Liberty Mutual Surety)

CE Barometer is sponsored by Liberty Mutual Surety (Photo: Liberty Mutual Surety)

This survey closed just before Russia invaded Ukraine, so the relative sense of optimism must be tempered by what has come since. At this point, there is no knowing what impact the current conflict will have on construction markets in Europe.

During the month of February, industry professionals looked back at the previous month and saw strengthening business.

Whereas, in the previous month, only 20.8% of respondents saw improving business levels, this month saw 37.1% of respondents reporting growth. Likewise, 21.0% reported a fall in business levels, compared with 27.8% in the previous month.

As a balance figure, with 0% being the status quo, the barometer saw a rise of 16.1%.

Looking back to this time last year, however, there is little movement from the previous month, with 54.8% reporting growth (0.6% up on the previous survey).

Those reporting slower business than a year ago was also slightly up, at 14.5%, compared with 12.5% in the previous barometer.

Again, looking ahead, there is not a significant change in confidence for the year ahead, but what change there is is negative. 54.8% of respondents forecast better business a year from now, compared with 56.9% in the previous survey.

Respondents predicting a fall in business activity rose 2% to 14.5%. In all, a relatively static barometer, but next month’s response almost certainly will not be.

The survey, which takes just one minute to complete, is open to all construction professionals working in Europe.

Visit www.construction-europe.com/ce-barometer or more info.

About the author

Scott Hazelton is a director with the Global Construction team at the market analyst IHS Markit.

Scott has over 30 years’ experience in construction, heavy equipment, building materials and industrial manufacturing markets.

CONECTAR-SE COM A EQUIPE