Why small construction equipment manufacturers face big challenges when developing new tech

12 October 2023

Large equipment manufacturers have the luxury of deep pockets to invest in automation, electrification and new business models – but life is not so easy for smaller machinery makers, says Alan Berger and Carl-Gustaf Goransson, from construction equipment consultancy abcg.

Image: SK via AdobeStock - stock.adobe.com

Image: SK via AdobeStock - stock.adobe.com

In so many areas of life, size matters.

And it’s certainly true when it comes to today’s major multiple shifts that are occurring simultaneously in the construction equipment industry.

The ‘triple technology challenge’ is ushering in new levels of automation and connectivity, alternative fuels and corresponding business models.

Large original equipment manufacturers (OEMs) have extensive resources and the economies of scale to allow them to invest in all these technology areas at the same time, with no negative impact on their existing product portfolio.

Carl Gustaf Göransson (Image supplied)

Carl Gustaf Göransson (Image supplied)

Developing all-new technologies in-house is expensive and smaller OEMs are usually forced to make trade-off decisions and depend upon suppliers for components and technologies.

They could just ignore the new tech, of course, but that is almost certain to consign them to dinosaur status some way down the road.

So doing nothing is not an option either.

Using off-the-shelf solutions from third-party suppliers solves one problem – but it also raises another spectre – that of machines all using the same basic componentry making it hard to differentiate from one manufacturers to another, accelerating the process of commoditisation.

So, the dilemma faced by smaller OEMs today is that without the resources to do most of this development in house, how can they survive and thrive in this challenging environment?

Barriers to entry are falling

Fortunately, technology development is getting a bit easier and less expensive as time moves on.

For example, there are now more suppliers of the building blocks that make up telematics systems available.

This means that smaller manufacturers can more easily shop around the various industry specialists and large tech companies and build a bespoke telematics system that suits their needs – and which they have full control over.

The same is true in automation, with toolkits evolving that make it easier for small OEMs to deploy their own automated machines.

This lowers the total investment needed – but does not eliminate the need to have a detailed market strategy and a capable development team.

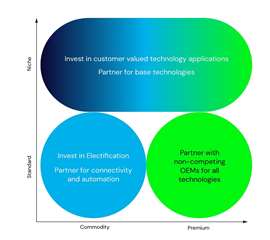

Choosing the ‘right’ path ahead depends significantly on the market position of the OEM.

Quite a few of the smaller OEMs are focused on technical niche products.

Source: abcg

Source: abcg

While other smaller OEMs compete in more standardized equipment categories, such as excavators or compact equipment.

For niche products, the volumes are small, and most tech suppliers will not focus on individual applications.

This is particularly true for automation, and to some level connectivity.

While this may appear to create a challenge for the smaller OEM, since they may not be able to find an off-the-shelf solution for their needs, it also allows them to capitalise on their deep specialised application knowledge and develop solutions that enhance the unique value they already provide.

Such OEMs should focus exactly on the technologies most valuable to their customers, and purchase or partner for the remaining technologies, using standardised offerings.

By doing so, they can minimize their technology investments while avoiding the potential transfer of value creation and therefore, profits to suppliers or tech companies.

Niche or mass market product line?

Smaller OEMs making more mainstream volume products don’t have as much opportunity to focus on unique application-specific technologies.

So, their approach needs to be different. Those with an outstanding cost position may choose to leverage that and focus on what they are best at – developing great products with a decent profit margin.

Alan Berger (Image supplied)

Alan Berger (Image supplied)

This would mean that purchasing connectivity and automation solutions might not pose a significant risk.

However, alternative fuels, particularly electrification, have significant product cost implications – and simply purchasing an electrified drivetrain would likely result in the loss of control of a large part of the product cost, not to mention denude companies of their core competencies and unique selling points.

This, in turn, would likely result in a significant decrease in profitability. Therefore, these smaller OEMs should focus on developing as much of the electrified system as possible.

The challenge is greater for those that rely on premium features and less on low-cost products.

Maintaining this market position will require differentiated offerings that incorporate all three technology elements of the ‘triple technology challenge’ – connectivity, automation and alternative fuels.

Partnering with non-competing OEMs

Since investment in all areas is likely to be too much, the best solution is to partner with non-competing OEMs that share the same challenges and combine resources to do a sufficient level of internal joint-development to maintain sufficient control to maintain profitability.

The industry transformation favours bigger, well-financed players.

Those with more limited resources have their work cut out for them.

But there is a pathway to success and future prosperity, by focusing on what makes them special, and partnering with technology firms or like-minded competitors on non-core componentry.

Alan Berger and Carl Gustaf Göransson are managing partners of the commercial vehicle advisory practice abcg.

CONECTAR-SE COM A EQUIPE